Chairman’s Message

As Mehkar, a part of Buldhana District in Central Maharashtra, nestled within the Vidharba Region, struggles with relative underdevelopment, featuring a population of 65,000 with limited access to basic infrastructure, education, and healthcare.

Adding to the challenges, only one Nationalized Bank, the State Bank of India, established in 1981, and a handful of Co-Operative Banks operated in Mehkar in the late 80s and early 90s. In such a backdrop, obtaining loans for housing, vehicles, education, and healthcare was an arduous task.

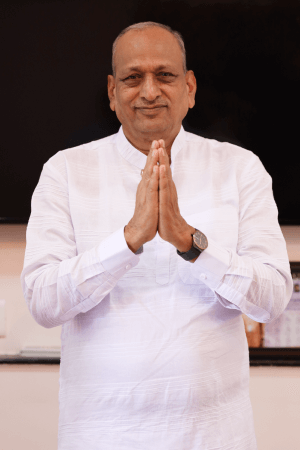

Recognizing this gap, I, Mr. Shyam Umalkar, along with 13 colleagues, identified an opportunity to establish a financial institution in Mehkar in the form of a Cooperative (Patsanstha). This initiative marked the revival of the Mehkar Urban Cooperative Credit Society, originally established in 1967 under the leadership of Mr. Bhausaheb Lodhe and Adv. Trambak Parashar, a founding member. Our reimagined approach was introduced in 1992.

Commencing with a mere Rs 65,000 in share capital, we embarked on a journey of day-to-day operations. Our focus was to extend our reach to people in the surrounding areas, including teachers, farmers, small business owners, government employees, and disadvantaged women. We offered the opportunity to open a Savings Account with just Rs 310 and Fixed Deposits starting at Rs 5,000. Within three months, we had successfully opened more than 500 accounts. Slowly but surely, our deposits grew to 50 lakh in the first six months, 1 crore in one year, and an astounding 3 crore in just two years.

Our mission was clear: to provide accessible funds to every segment of the community, from micro-level businessmen and disadvantaged individuals struggling with their daily lives to students pursuing higher education, farmers in need of seeds and agricultural support, and young people seeking new vehicles or women aspiring to acquire sewing machines and engage in handicrafts.

Securing loans from nationalized or cooperative banks was often a cumbersome and document-intensive process, limiting access to those in need. Satyajeet Co-Operative Credit Society emerged as a beacon of trust and ethical lending, simplifying the loan approval process against property. Payback was assured, fostering confidence among the local populace.

Moreover, we believed it was our moral obligation to give back to society through various charitable initiatives if the organization proved profitable. Year after year, Satyajeet Co-Operative Credit Society diligently pursued social improvement through numerous community programs.